44+ rental property mortgage interest deduction

It does mean their taxes didnt go down at all for incurring mortgage interest. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property.

Understanding Tax Deductions On Your Rental Property

71-268 long as the person paying the interest and taxes has an ownership interest in the property then that person can deduct the full amount paid.

. You take the total mortgage and divide it by the limit to give you the ratio of interest paid you are. The Best Lenders All In 1 Place. Web 7 Tax Benefits of Owning a Home.

Web What Deductions Can I Take as an Owner of Rental Property. Web The rental property mortgage interest deduction offers significant tax benefits. Web But there is a second step now because you cannot deduct all of that interest.

Home improvements to age in. Web About 44 of US. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Low Fixed Mortgage Refinance Rates Updated Daily. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web See Rev.

Web This doesnt mean they werent eligible for the mortgage deduction all the same. Homes are worth enough to take full advantage of the mortgage interest deduction. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

Instead these expenses are added to your basis in the. Web You itemize the following deductions as a single individual. Homeowners who bought houses before.

Web Up to 96 cash back Rental property. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Heres how it works using an example property purchased for 325000 with a.

Mortgage interest 6000 student loan interest 1000 and charitable donations 1200. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Under proposed changes that share drops to 125.

No SNN Needed to Check Rates. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional.

You report this mortgage. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Use Schedule E 1098 You can deduct mortgage interest on rental property as an expense of renting the property. Ad Shortening your term could save you money over the life of your loan. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Can You Deduct Mortgage Interest On A Rental Property

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Home Mortgage Loan Interest Payments Points Deduction

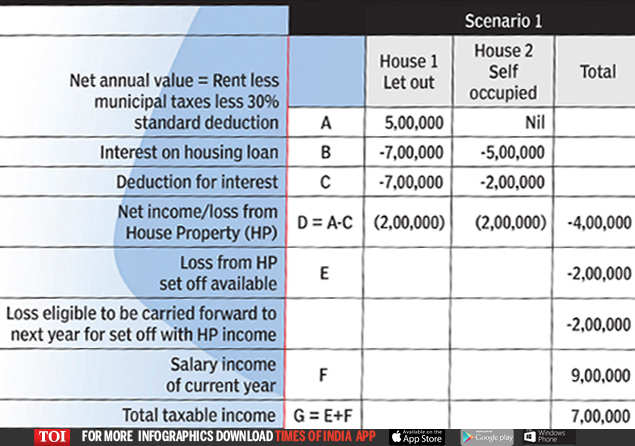

House Rent How To Castle For A Cut Times Of India

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Is Your Mortgage Considered An Expense For Rental Property

Free 44 Expense Forms In Pdf Ms Word Excel

Is Your Mortgage Considered An Expense For Rental Property

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

Is Your Mortgage Considered An Expense For Rental Property

Tax 1 And 2 Reviewer Atty Sababan Pdf

Equity Meaning Formula Examples Calculation Importance

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield